AssetAccountant is sophisticated fixed asset software that takes care of all of your fixed asset depreciation and leasing.

Australia and the Australian Taxation Office (ATO) have unique and intriguing perspectives and regulations regarding the implementation of taxes and depreciation in relation to vehicles, as outlined in the information provided below.

Of course AssetAccountant navigates all of these rules elegantly.

ATO Definition, What is a "Luxury Car"?

The ATO has a somewhat different definition of what a luxury car is compared to the average person in an average context.

For most of us, we think of luxury cars as a German performance car or one of the many fancier 4WDs that have become popular in recent years.

But for taxation and depreciation purposes, the definition is more about thresholds.

The ATO defines a ‘luxury car’ as any motor vehicle that has a purchase price exceeding the luxury car threshold.

The luxury car threshold is indexed yearly but is at the time of writing it is $68,740 or $77,565 for fuel efficient cars (effective from July 2020).

This means the ATO definition of luxury cars can include those often considered mainstream vehicles – E.g. sedans, station wagons, SUVs and 4 Wheel Drives (4WDs).

AssetAccountant – saving you from spreadsheets since 2019

Luxury Car Tax

Luxury cars are subject to a Luxury Car Tax when sold or imported into Australia.

The LCT is set at 33% and applies to the value of cars with a GST-inclusive value above the Luxury Car Threshold of $68,740.

This tax is paid by businesses that sell or import luxury cars (dealers), and also by individuals who import luxury cars.

For example, a $100,000 BMW imported into Australia exceeds the $68,740 luxury car limit, so $31,620 will be subject to the Luxury Car Tax. At the 33% rate, $10,316 Luxury Car Tax will be payable to the ATO by the importer (and no doubt on-charged to you or your business!)

What is the depreciation allowance or "Car Limit" as the ATO refers to it?

The car limit effective from Jul 2020 is $59,136 and from Jul 2021 is $60,733. This maximum allowance for depreciation applies to passenger vehicles designed to carry a load less than one tonne and fewer than nine passengers.

So if you buy a vehicle for business and it cost $100,000 (NB: irrespective of any amount you were paid for a trade-in), only $59,136 of this amount is able to be depreciated.

The “one tonne” limit deserves a closer look.

The one tonne limit relates to the maximum load your vehicle can carry, also known as the payload capacity.

The payload capacity is the Gross Vehicle Mass (GVM) reduced by the basic kerb weight of the vehicle.

The GVM is always noted on the compliance plate by the manufacturer,

The basic kerb weight is the weight of the vehicle with a full tank of fuel, oil and coolant together with spare wheel, tools (including jack) and factory-installed options (NOT including passengers, goods or accessories added after original specifications).

Which vehicles are exempt from the Car Limit?

The full purchase cost of these exempt vehicles can be depreciated:

- Any vehicle with a payload (calculated as per above) of greater than 1 tonne.

- Also any vehicle designed to carry 9 or more passengers.

- It does not apply to motorcycles or similar vehicles.

- Or to vehicles fitted out for use by people living with a disability.

Taxable use

If you use your vehicle for both business and private use, you can only claim the cost of

the business portion. This applies not only to vehicles, but applies to all assets you intend to depreciate.

If the car limit above applies to the vehicle in question, the depreciation deduction is limited to the business portion of the car limit.

For example, if you use your vehicle for 80% business use, and it cost more than $59,136, the total you can claim depreciation is 80% of the car limit of $59,136 which equals $47,308.

We take depreciation and leasing seriously

We undertake detailed modelling of fixed asset depreciation and lease calculation rules for both accounting and tax.

We monitor changes to ATO tax rulings and accounting standards like IAS 16 and IFRS 16 so you don’t have to.

And, of course, we are ISO27001 certified.

We take depreciation and leasing seriously

We undertake detailed modelling of fixed asset depreciation and lease calculation rules for both accounting and tax.

We monitor changes to IRS tax rulings and accounting standards like US GAAP and ASC 842 so you don’t have to.

And, of course, we are ISO27001 certified.

We take depreciation and leasing seriously

We undertake detailed modelling of fixed asset depreciation and lease calculation rules for both accounting and tax.

We monitor changes to IRD tax rulings and accounting standards like IFRS 16 so you don’t have to.

And, of course, we are ISO27001 certified.

We take depreciation and leasing seriously

We undertake detailed modelling of fixed asset depreciation and lease calculation rules for both accounting and tax.

We monitor changes to tax rulings and accounting standards like IFRS and US GAAP so you don’t have to.

And, of course, we are ISO27001 certified.

Why our clients love AssetAccountant

Fantastic product - has literally saved me hours of work.

Ever wanted the big company fixed asset system without all the clunkiness and overthinking on the part of the software developers (I'm looking at you Thomson Reuters...)? Well then you need AssetAccountant. It provides just the right mix of complex depreciation calculations and beautiful user interface. It's a system designed by accountants and executed perfectly by developers. The integration is seamless with Xero (you can sign into AA with Xero credentials which is awesome if you are already running Xero on your browser) and journaling synchs are very flexible between the two applications. Then there is the price. I challenge you to find a more robust fixed asset system at these price points. Well done AssetAccountant.

You get me.

I now have my big boy jocks back on for fixed asset management....and they fit!

GST consideration for depreciable amount and the Car Limit

If you’re registered for GST and can claim the full GST credit, exclude the GST amount you paid on the car for depreciation purposes.

If you’re not registered for GST, include the GST amount you paid on the car.

What About the Instant Asset Write Off?

Vehicles are able to take advantage of the Backing Business Investment Instant Asset Write Off rules.

Although if you’d prefer not to claim the full amount of depreciation for tax purposes, you don’t have to.

If your business is eligible to claim the instant asset write-off, you need to consider the car limit as described above. You cannot write-off more than this limit for a vehicle.

Maintaining your fixed asset register is crucial – try out AssetAccountant for free today

Ready to kick some assets?

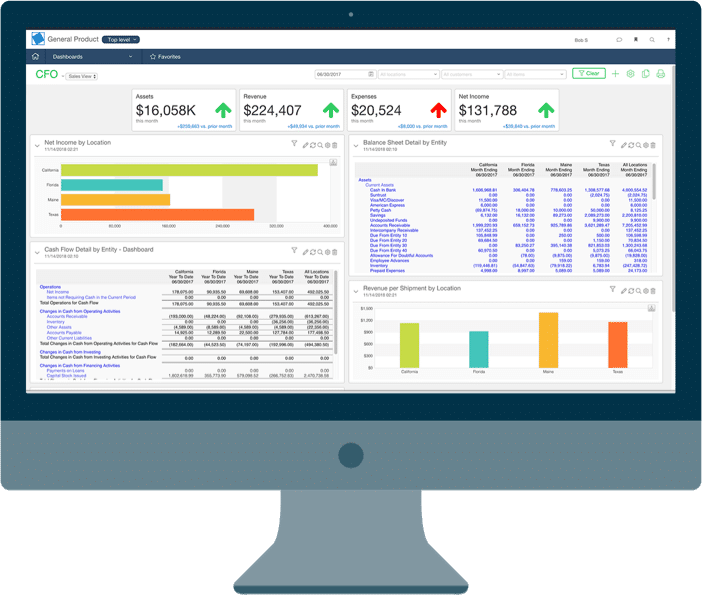

- AssetAccountant is fixed asset software that automates fixed asset depreciation & lease accounting and posts their journals to the General Ledger.

- AssetAccountant combines detailed interpretation of Tax and Accounting rules with a modern user interface design, to simplify the process of creating and maintaining your fixed asset register.

- AssetAccountant is sophisticated enough for Wall Street, user-friendly enough for main street.

- AssetAccountant is for worldwide application 🌎