Managing fixed assets for tax and accounting purposes can be a challenging task. It necessitates the implementation of a well-structured, consistent, and compliant system that produces dependable and precise depreciation outcomes.

Specialist fixed asset depreciation and lease accounting software (AssetAccountant), that also integrates with QuickBooks Online, provides your fixed asset manager with the tools needed to optimise the quality of the fixed assets register and support sound decision making about fixed asset priorities.

The stakes are far too high to risk significant errors in your fixed assets register that lead to errors in tax and accounting outcomes.

Move away from error-prone spreadsheets

Many fixed assets registers are ‘home grown’ spreadsheets that attempt to calculate tax or accounting depreciation, but rarely both.

And while using spreadsheets year after year someone must program and update the worksheets and workbooks manually.

Creating and maintaining these depreciation spreadsheets requires a tremendous expenditure of time, and yet they are prone to many problems, including:

- Errors that go unnoticed and cause miscalculations,

- Rule and regulation changes that do not get incorporated,

- Missing audit trails and history,

- Difficulty in changing depreciation methods for an asset,

- Difficulty in exchanging data with other accounting applications.

Spreadsheets can certainly perform complex mathematical calculations. They are, however, not the best tool for managing fixed assets. What your clients need is a combination of database and calculation engine.

Accounting Today, Ted Needleman

Look for a scalable solution

When selecting a fixed assets register software, consider the size of your organisation and the number of fixed assets, as well as potential for future growth.

Ask about the scalability of the software you are evaluating.

If your business is small, ask if the provider offers a version of the software designed for the needs of small businesses and available at an affordable price.

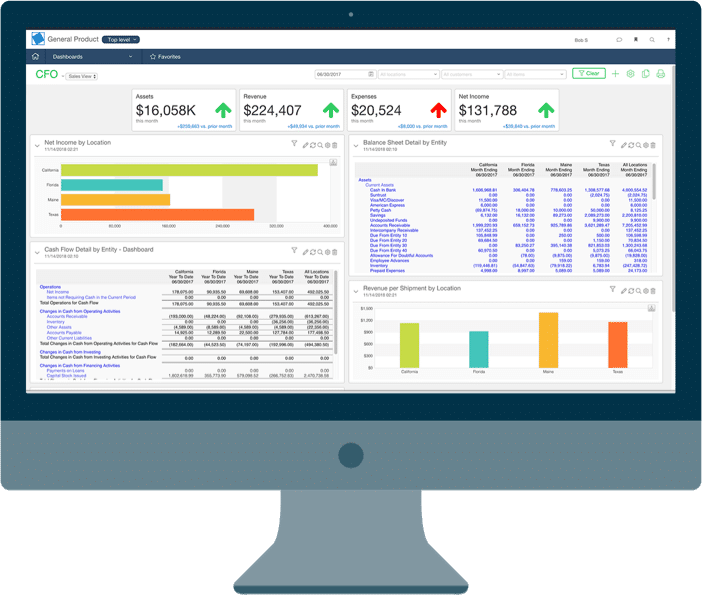

If your business is midsized or larger, can you add integrated products for additional functionality, project accounting, and advanced reporting?

As your company acquires more assets, will the fixed assets register scale to meet the needs of an expanding fixed asset database?

Is the reporting package extensive?

Can you get customised reports (for a fee) based on your organisation’s changing needs?

AssetAccountant – saving you from spreadsheets since 2019

Take advantage of integration to other applications

To reduce the risk of needless error and make the best use of your time, it is essential that the fixed asset register that you select integrates with your accounting system.

All fixed asset register modules should integrate seamlessly together and reconcile.

Additionally, your fixed assets register should be able to exchange data with your general ledger and other accounting systems.

Whenever data can be automatically shared between your applications, valuable time is saved that would otherwise be spent manually rekeying critical data.

Integration also ensures that clerical errors, such as typos, do not cost your organisation money and compromise accuracy.

Effectively evaluate fixed asset management software

Fortunately, fixed asset management software solutions exist that can automate the process, while saving time and eliminating the errors associated with spreadsheets.

In reviewing fixed asset software packages for the CPA Technology Advisor, Isaac O’Bannon recommends examining navigation and ease of use, management features, integration, reporting abilities, and the quality of technical support and software updates.[i]

Carefully review both providers and solutions as you conduct your evaluation.

Find out how other customers are benefiting from the solution.

Ask for a demonstration or try out an evaluation copy at your company.

By beginning your search for a solution with a clear idea of the features you would find most beneficial and selecting from vendors that have expertise, you’ll ensure that you find the software that is right for your organisation.

[i] Isaac M. O’Bannon, “Forecasting Capabilities Aid in Long-Term Depreciation Strategies: A Review of Fixed Asset Software,” The CPA Technology Advisor, November 2004

- Cloud-based, easy to access

- Reduce data entry errors using workflows during the creation of new assets.

- Import existing data from your current solution or spreadsheet easily.

- Get comprehensive help and documentation features that are easy to use.

- Customise fields and define for the specific needs of your organisation.

- Search for, define, and edit assets quickly with query or grouping features.

- Make sure you can output reports to avoid rekeying of depreciation data.

- A variety of prebuilt reports.

- Ability to get customised reports created.

- Select a vendor that demonstrates expertise in fixed asset management.

- Seek out feedback on both the product and the company.

- Look for demonstrated commitment to technical support as well as easy access to support, when you require it.

- Provide regular updates accommodating tax law changes.

- Get a solution that fits your business model.

- Enable the free flow of data both into and out of the fixed asset register.

- Integrate with general ledger software, saving time and reducing clerical errors.

- Safeguard the accuracy of depreciation data with essential security features.

QuickBooks Online and AssetAccountant

Can help you and your business to manage risk, time and give you confidence in the quality and compliance of the Fixed Asset register and financial reports.

Experts here to help

We don’t want to add to the finance departments burden.

We want to make both Fixed Asset register conversion and maintenance easier both now and into the future, with:

- Free asset register conversion

- Chart of Accounts mapping

- Compliance updates

We constantly monitor the ATO and make the updates without your finance team needing to understand the ‘ins and outs’ or needing to make changes to the Fixed Asset register themselves.

AssetAccountant™ can help you and your business to manage risk, time and give you confidence in the quality and compliance of the Fixed Asset register and financial reports.

Why our clients love AssetAccountant

Fantastic product - has literally saved me hours of work.

Ever wanted the big company fixed asset system without all the clunkiness and overthinking on the part of the software developers (I'm looking at you Thomson Reuters...)? Well then you need AssetAccountant. It provides just the right mix of complex depreciation calculations and beautiful user interface. It's a system designed by accountants and executed perfectly by developers. The integration is seamless with Xero (you can sign into AA with Xero credentials which is awesome if you are already running Xero on your browser) and journaling synchs are very flexible between the two applications. Then there is the price. I challenge you to find a more robust fixed asset system at these price points. Well done AssetAccountant.

You get me.

I now have my big boy jocks back on for fixed asset management....and they fit!