Lease accounting can be an exceedingly burdensome undertaking, especially when it pertains to journal entries, financial reports, and bank reconciliations.

And when leased assets are also refinanced, it gets even more complex.

Wouldn't it be great if there was lease accounting software that could automate all of this for you, and let you just 'set and forget' your finance leases, hire purchases and right of use assets?

Leasing Schedules Automation

Set and forget every lease

What you need to know about

lease accounting 🌏🌎🌍

Leases are a crucial part of funding strategies that help you maintain the overall financial health of your business but accounting for them can be tricky. However, aside from being a legal requirement, accurate lease accounting enables you to track your leasing activities and manage this important source of funding.

Lease accounting shows the financial impacts of your lease activities, which need to be disclosed in all areas of your financial statements including:

- Balance sheets

- Cash flow statements

- Income statements

The way leases are reported in financial statements will depend on whether you’re the lessor (the one providing the asset to be leased) or the lessee (the one paying for the leased asset). If you are the lessor, you will have a number of special rules to follow to account for your income.

The rest of this page’s content focuses on accounting as a lessee.

Learning how lease accounting works will enable you to make more informed business decisions. It also makes sense to monitor your leasing activities through a better understanding of the process which will ensure your compliance with relevant laws and accounting standards and will also help you develop effective and up-to-date financial strategies.

What is a lease?

A lease is a way for a business to either:

- finance the purchase of an asset or

- pay for the use of an asset

There are many ways that leases can be structured which historically may have had different accounting treatments depending on various factors within the lease. However, in recent years there has been a move to standardize the accounting treatment so that financial statements show the same result where assets are funded based on a leasing arrangement. This has been enacted internationally under IFRS16 for a number of years and is now being adopted in the US via ASC842.

The process of accounting for leases can now be thought of as follows:

- Initially recording the asset and lease – Calculate the current value of the asset, which will serve as the recorded cost. You should record this as a debit to the corresponding fixed asset account as well as a credit to the lease liability account (split between current and non-current). The lease liability accounts will record the amount equal to the lease payments over the lease term as well as the interest accrued between the previous lease payment and the balance sheet date.

- Lease payments – Allocate and record a portion of the lease invoice as an interest expense and funnel the rest of the amount into reducing the balance of your lease liability accounts so that these are eventually brought down to zero over the life of the relevant lease.

- Depreciation – An asset recorded as a leased asset is still a fixed asset that depreciates in line with a business’s accounting policies.

- Disposal – Once the asset is disposed of, the recorded fixed asset account is credited while the accumulated depreciation account is debited, this step will allow you to calculate whether there is a gain or loss since the disposal transaction occurred.

The accounting treatment of leases is subject to change, so it’s important to keep track of legislative updates. The introduction of ASC 842 is a relevant example of significant change that impacts lease accounting.

AssetAccountant – saving you from spreadsheets since 2019

🇺🇸 ASC 842:

How the new leasing standard comes into play

In February 2016 the Financial Accounting Standards Board (FASB) issued ASC 842 as the new lease accounting standard in the United States. The legislative change requires leases longer than 12 months to be recorded as assets and liabilities on a balance sheet. Public entities have been in compliance with this standard since 2016, but private companies are mandated to adopt this standard in fiscal years after December 15, 2021.

Outside of the United States, the International Accounting Standards Board (IASB) follows IFRS 16, which recognizes finance leases and completely eliminates operational leases, though it also requires leases longer than 12 months to be recorded on a balance sheet.

ASC 840, which is the previous lease accounting standard in the United States, allowed operational leases to be written off as operating expenses. This excluded them from certain calculations and had the potential to result in a skewed overview of a company’s financial performance. ASC 842 has removed this ambiguity and replaced it with a more transparent calculation of operational leases, benefiting investors and companies and encouraging more accurate lease accounting.

Instead of being written off as operational expenses, the present value of committed future payments for operational leases are recorded on the balance sheet as a lease liability that is offset by a right-of-use (ROU) asset. Other leases are still calculated the same way under the standard, but the qualifications have changed for this type of lease.

The generally accepted accounting principles (GAAP) previously used the bright-line test to classify a finance lease. Under ASC 842, a finance lease must now include at least one of the conditions in its contract to be recognized as compliant with the GAAP:

- Transferral of ownership to the lessee after the end of the initial lease

- The lessee is certain they will consider the purchase option at the end of the lease term

- The lessor has no alternative use for the leased asset after the lease term

- The lease term covers a major portion of the asset’s total useful life

- The present value of lease payments is substantially all of the fair value of the leased asset

Since adopting ASC 842, both public and private entities are addressing lease accounting activities and issues as they evaluate their business operations and structures. The ongoing

activities of entities that have adopted ASC 842, discovered in a survey completed by Deloitte, include:

- Impairment and abandonment – The ASC 360-10 guidance in accounting for impairment and abandonment applies to ROU assets. An asset group should be tested for impairment if events indicate that the carrying amount of the asset group may not be recoverable. Abandonment accounting only applies if the asset subject to the lease is no longer used for any business purpose, including storage.

- Subleases – The original lease between the lessor and lessee typically remains in effect, though the lessee will stand as the immediate lessor when they find a third party that will lease the asset.

- Modification of existing lease arrangements – Lessees are modifying their existing leases by scaling back office space or expanding the leased space in consideration of social distancing.

- Sale-and-leaseback arrangements – This involves the transfer of a property by the owner (lessee-seller) to an acquirer (lessor-buyer) as well as a transfer of a right to control the same asset to the owner for a certain period of time.

The FASB has released various ASUs to ensure a smoother transition and improve the standard. Most notably, the FASB has issued the ASU 2021-05, which changed the accounting for lessors of leases with variable payments that are independent of an index or rate. This amendment is designed to eliminate the possibility that an economically profitable arrangement would lead the lessor to a loss at the inception of a lease as a result of the ASC 842 measurement requirements for leases with variable payments.

How AssetAccountant's lease accounting software can help your business with lease accounting

Many accountants manage lease activities through spreadsheets, which can become complicated with formulae. Setting up the formulae in spreadsheets can also lead to incorrect accounting and calculations as accountants cross-check your spreadsheet against your ledge while doing line-by-line reconciliations. The spreadsheet file size can also be burdensome because it can become heavy and unwieldy, especially when sent back and forth to be updated.

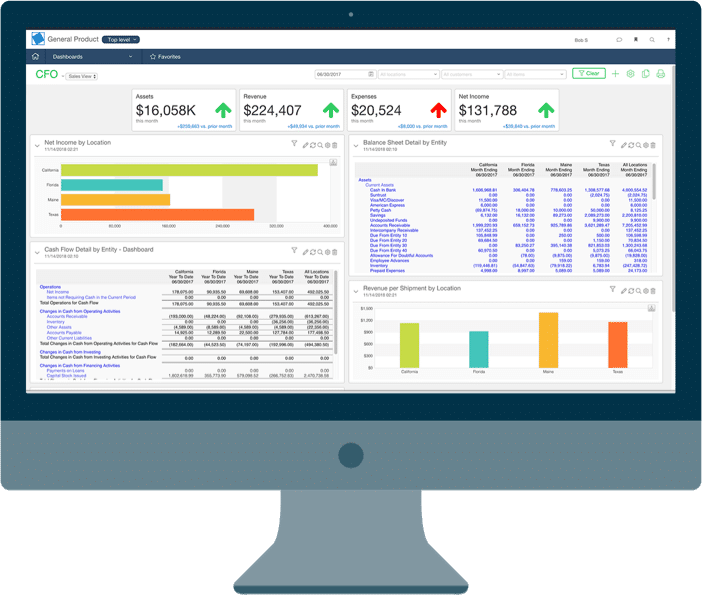

The video showcases the advantages of using the AssetAccountant leasing engine.

“Set and forget”.

AssetAccountant’ empowers you to manage your leased and capitalised assets side by side, for both accounting and tax.

This is especially relevant now with the advent of IFRS 16, and the FASB’s declaration of ASC 842 as the new lease accounting standard for both public and private entities in the United States

These new accounting standards add yet another layer of compliance effort for all businesses.

We’ve responded with a low-cost and user-friendly treatment of both leased and capitalised assets that will see you saving countless hours wrestling with spreadsheets.

Once you or your accountant have the details about the lease, you can simply input it into AssetAccountant, generate journals in advance and enables you to process the data in one pass.

We hope you enjoy our walkthrough video of how easy lease accounting can be. Please contact us if you’d like to learn more.

We take depreciation and leasing seriously

We undertake detailed modelling of fixed asset depreciation and lease calculation rules for both accounting and tax.

We monitor changes to ATO tax rulings and accounting standards like IAS 16 and IFRS 16 so you don’t have to.

And, of course, we are ISO27001 certified.

We take depreciation and leasing seriously

We undertake detailed modelling of fixed asset depreciation and lease calculation rules for both accounting and tax.

We monitor changes to IRS tax rulings and accounting standards like US GAAP and ASC 842 so you don’t have to.

And, of course, we are ISO27001 certified.

We take depreciation and leasing seriously

We undertake detailed modelling of fixed asset depreciation and lease calculation rules for both accounting and tax.

We monitor changes to IRD tax rulings and accounting standards like IFRS 16 so you don’t have to.

And, of course, we are ISO27001 certified.

We take depreciation and leasing seriously

We undertake detailed modelling of fixed asset depreciation and lease calculation rules for both accounting and tax.

We monitor changes to tax rulings and accounting standards like IFRS and US GAAP so you don’t have to.

And, of course, we are ISO27001 certified.

Why our clients love AssetAccountant

Fantastic product - has literally saved me hours of work.

Ever wanted the big company fixed asset system without all the clunkiness and overthinking on the part of the software developers (I'm looking at you Thomson Reuters...)? Well then you need AssetAccountant. It provides just the right mix of complex depreciation calculations and beautiful user interface. It's a system designed by accountants and executed perfectly by developers. The integration is seamless with Xero (you can sign into AA with Xero credentials which is awesome if you are already running Xero on your browser) and journaling synchs are very flexible between the two applications. Then there is the price. I challenge you to find a more robust fixed asset system at these price points. Well done AssetAccountant.

You get me.

I now have my big boy jocks back on for fixed asset management....and they fit!

Ready to kick some assets?

- AssetAccountant is fixed asset software that automates fixed asset depreciation & lease accounting and posts their journals to the General Ledger.

- AssetAccountant combines detailed interpretation of Tax and Accounting rules with a modern user interface design, to simplify the process of creating and maintaining your fixed asset register.

- AssetAccountant is sophisticated enough for Wall Street, user-friendly enough for main street.

- AssetAccountant is for worldwide application 🌎