[vc_row][vc_column][vc_column_text]We’ve mastered depreciation, so you don’t have to.[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column][vc_column_text]We’ve mastered depreciation, so you don’t have to.[/vc_column_text][/vc_column][/vc_row]

Why is fixed asset depreciation important for small business? Fixed asset depreciation plays a crucial role in fiscal management for …

Accounting software and asset management automation The automation of accounting processes and software entails utilizing software solutions to streamline finance …

What is fixed asset depreciation? Fixed asset depreciation is a universally accepted accounting technique utilized to incrementally transfer the cost …

Now available in the Microsoft Azure Marketplace MEDIA RELEASE Microsoft Azure customers around the world can now access AssetAccountant to …

For any business that owns physical assets, maintaining a fixed asset register is an essential task. A fixed asset register …

The Internal Revenue Service (IRS) has developed a complex structure for calculating depreciation. It’s important to understand how each step …

ASC 840 (replaced by ASC 842) ASC 840 refers to the Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) …

This is an article written in January, 2023 by Mike Roberts – Our Head of Strategy and Business Development Lease …

Many businesses choose to use some sort of financial arrangements for purchasing their assets. There are numerous methods to structure …

Lease accounting can be an exceedingly burdensome undertaking, especially when it pertains to journal entries, financial reports, and bank reconciliations. …

Fixed asset software is a crucial tool for businesses of all sizes. It helps companies manage and track their physical …

The recent introduction of new leasing standards such as ASC 842 and IFRS 16 has significantly impacted private companies, requiring …

Section 179 depreciation and bonus depreciation: Tax incentives that can benefit your business Tax regulations are subject to frequent revisions …

Why are Profit Centres Used in Financial Reporting? Businesses of all sizes have various reasons for wanting to separate different …

What is accumulated depreciation? Accumulated depreciation is a fundamental principle in accounting, especially in the areas of asset control and …

Accounting Depreciation Vs Tax Depreciation for Assets Many accountants prefer to maintain a single fixed asset register for their clients’ …

Let’s face it, reconciling fixed assets at tax time is tedious, awkward and (most of all) stressful. Let’s review the …

In accounting, what is the definition of current assets? Current assets are the assets of a company that are anticipated …

How do you calculate diminishing value depreciation? How does diminishing value depreciation compare to prime cost (straight line) methods? It …

Here are some examples of which asset cannot be depreciated: Considering that a definition of fixed assets is: An asset …

Making fundamental changes to fixed assets in your register In the above video, we’re going to look at all the …

Many AssetAccountant users depreciate some or all of their assets by using a “pool” as permitted by the ATO. What …

The due date for federal income tax returns for businesses in the United States depends on the type of business …

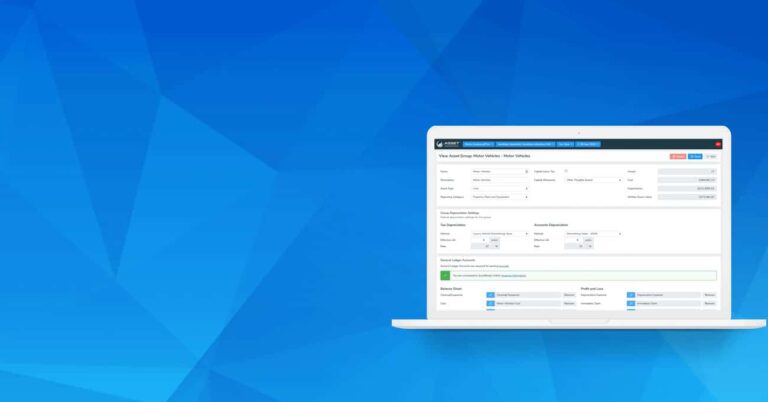

Setting up asset groups and GL mapping How to add asset groups and how to set them up. This is …

Account structure for both businesses/corporations and accounting firms in AssetAccountant The account structure and AssetAccountant. There are two types of …

User roles and permissions for using AssetAccountant User roles in AssetAccountant can be administered and managed using both the organization …

Here at AssetAccountant, we have seen many implementations of the fixed asset depreciation software. We have received numerous inquiries regarding …

Fixed asset lease accounting software: Overview In this video, I will show you the basic functionality AssetAccountant has for managing …

But our ERP has a fixed assets module… We are sometimes asked the question: Why should we use a third …

Fixed asset depreciation software: Introduction When you create a free trial account with AssetAccountant, you’ll be offered the opportunity to …

Managing fixed assets and calculating depreciation Sounds pretty straightforward, right? You buy an asset and write it off over its …

Getting Set Up In AssetAccountant Creating a free trial account with AssetAccountant is easy. You can either click on the …

Managing revaluations and impairments of fixed assets One of the areas of complexity that our users come to us with …

One-click journal postingTracking category supportDraft assets pull-through AssetAccountant have clients who work with all sorts of accounting systems where the …

Tax Depreciation Incentives and Instant Asset Write-Off (IAWO) Tax Nuggets Academy has done it again. Joyce in her distinctive style …

Fixed Asset Software For Sage Intacct AssetAccountant was approached by Sage Intacct in 2020 to be the recommended fixed assets …

Who is ISO? ISO stands for International Organisation for Standardisation. It a non-governmental organisation formed by a network of standards …

For years, you’ve lovingly built and curated your fixed asset depreciation spreadsheet. Complete with elegant formulas, inspired macros and beautiful …

AssetAccountant is sophisticated fixed asset software that takes care of all of your fixed asset depreciation and leasing. Australia and …

Income Tax Assessment Act 1997 – Division 43 (Deductions for capital works) Division 43 (Div43) allows deductions for buildings and …

The Example: Jacki Chiles is a sole proprietor manufacturing furniture and trading as Pendant Furniture. His annual turnover is $1.4m …

Fixed Assets Accounting When we refer to fixed assets, we are referring to longer term assets. These are assets that …

Managing fixed assets for tax and accounting purposes can be a challenging task. It necessitates the implementation of a well-structured, …

Fixed asset depreciation software and lease accounting software. Saving you from spreadsheets since 2019.

Please wait while you are redirected to the right page...