Managing fixed assets and calculating depreciation

Sounds pretty straightforward, right?

You buy an asset and write it off over its useful life using a method prescribed either by your own accounting policies or the relevant tax authorities.

Well, in practice, whilst this may sound simple, there are lots of real life day-to-day examples of events that occur which can complicate these matters considerably.

At AssetAccountant, creators of fixed asset depreciation and lease accounting software, we make it our mission to make managing these events as easy as possible.

Some examples and the kinds of functionality we provide are set out below:

Partial disposals

There may be occasions on which you wish to dispose of part of an asset or write off a number of assets you acquired in bulk.

For example:

- A business or individual may sell part of a block of land; or

- A hotel chain may write off 20 of 100 chairs it bought in bulk when they were damaged beyond use

AssetAccountant™ supports all these kind of scenarios by allowing the user to take one or more of the following actions:

- Setting a unit for an asset or collection of assets such as area or number of items

- This can be set at time of purchase, time of partial disposal or any point in between

- Allowing for disposal of a partial amount of the asset in question

- Managing all the associated reporting and journaling following this event

Components

Many businesses have the need to connect assets together and treat some as components of a parent asset.

An example of this would be the tray on the back of a truck which could be replaced independently of the rest of the truck.

In AssetAccountant™, users are able to specify a parent-child relationship between assets allowing for easy visibility and management of assets which are components of others.

Why our clients love AssetAccountant

Fantastic product - has literally saved me hours of work.

Ever wanted the big company fixed asset system without all the clunkiness and overthinking on the part of the software developers (I'm looking at you Thomson Reuters...)? Well then you need AssetAccountant. It provides just the right mix of complex depreciation calculations and beautiful user interface. It's a system designed by accountants and executed perfectly by developers. The integration is seamless with Xero (you can sign into AA with Xero credentials which is awesome if you are already running Xero on your browser) and journaling synchs are very flexible between the two applications. Then there is the price. I challenge you to find a more robust fixed asset system at these price points. Well done AssetAccountant.

You get me.

I now have my big boy jocks back on for fixed asset management....and they fit!

Second element of cost

Following on from components, in some cases, these can be treated as a “second element of cost” of the parent asset with specific tax rules applying to these grouped assets.

Other examples of needing to apply the “second element of cost” rules are for items such as installation costs which should just be added to the original cost of the asset.

AssetAccountant™ has the ability to specify that a particular component of an asset is a “second element of cost” in relation to the parent asset and its value will be depreciated accordingly.

In AssetAccountant™, users can add second elements of cost to underlying assets to be depreciated along with the original asset (for cases where the costs are not going to be split out from the asset in the future).

Work in progress/assets under construction

Although most fixed assets are typically acquired in a single event, there are instances where an asset is formed through multiple purchases made over a period of time before it is finally put into use.

Within AssetAccountant™ it is possible to add multiples purchases to combine to a total value to be depreciated when the overall asset is first put into use.

Different cost basis for book and tax

There are plenty of scenarios where (as counter-intuitive as it may sound), different cost bases and dates of first use are needed in the tax and accounts books.

AssetAccountant™ treats assets within books separately to cater for any scenario where users have the need to specify differing values for dates and/or cost to be depreciated.

AssetAccountant – saving you from spreadsheets since 2019

Ready to kick some assets?

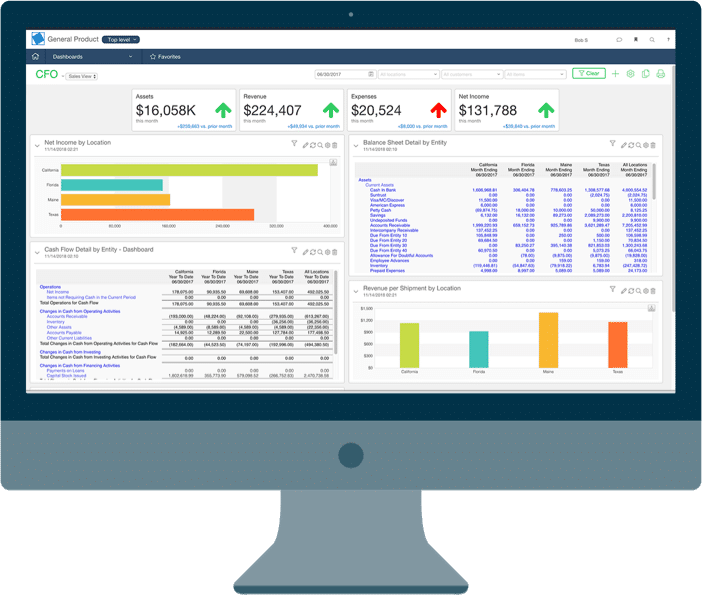

- AssetAccountant is fixed asset software that automates fixed asset depreciation & lease accounting and posts their journals to the General Ledger.

- AssetAccountant combines detailed interpretation of Tax and Accounting rules with a modern user interface design, to simplify the process of creating and maintaining your fixed asset register.

- AssetAccountant is sophisticated enough for Wall Street, user-friendly enough for main street.

- AssetAccountant is for worldwide application 🌎