Account structure for both businesses/corporations and accounting firms in AssetAccountant

The account structure and AssetAccountant.

There are two types of subscribers to our service: Businesses and corporations, and accounting firms.

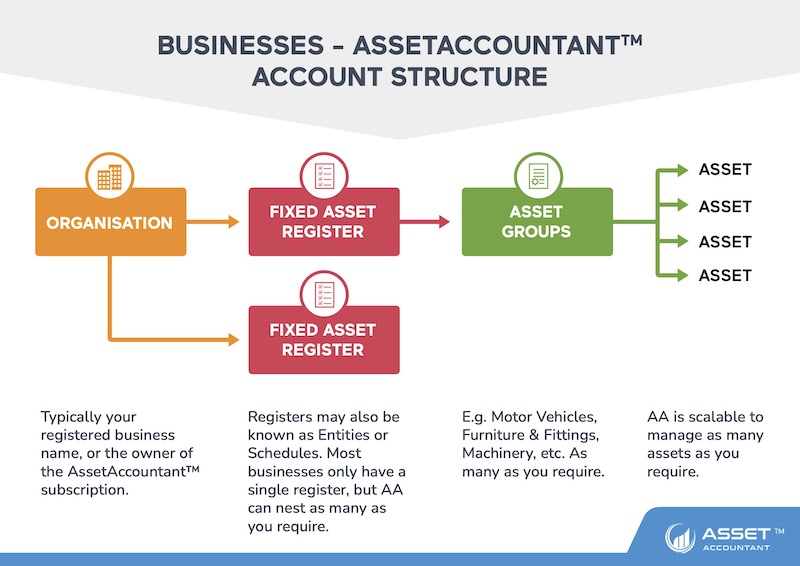

Firstly, businesses and corporations. In a typical setup, the account holder is known as the organization and will appear in the top left hand side menu at the top of the interface. Nested beneath the organization are individual fixed asset registers. Fixed asset registers may also be known as entities or fixed asset schedules.

Whilst many businesses only have a single register, AssetAccountant can nest as many as you require within each register. Navigate to the assets menu item on the left hand side. You can add as many asset groups as you need via the interface. The asset groups can also be added when importing assets from a spreadsheet file. Within each asset group. You can proceed to add as many assets as you need, either via the interface or again, by importing in bulk from a spreadsheet file, adding groups and assets via AssetAccountant’s, powerful importing tools, or the subject of other videos you can search for in this video hub.

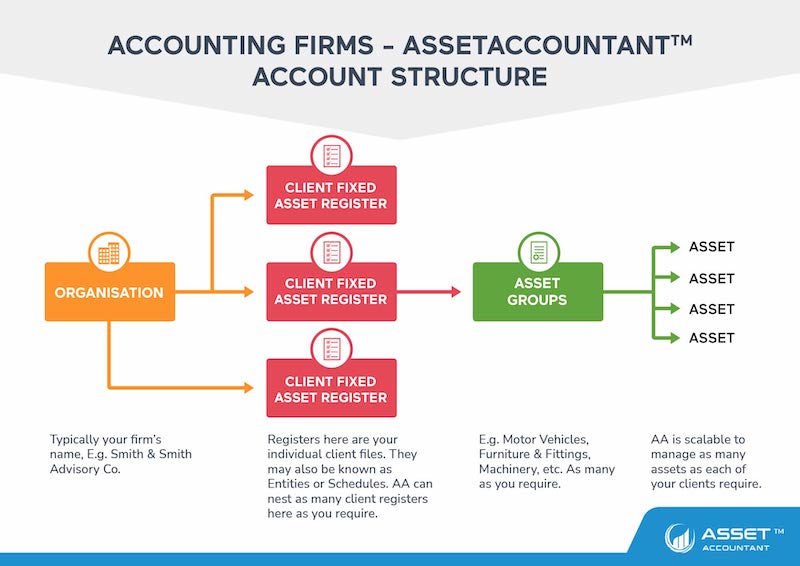

Furthermore, in the case of accounting firms, similar to businesses, a subscriber from an accounting firm will also be referred to as the organization. For instance, if your firm is named Smith and Smithed Advisory Company, it will be nested under your firm’s account. All the fixed asset registers of your individual clients will be displayed here once they are included in your account. The procedure for adding asset groups and individual assets to these groups remains identical to that of businesses.

We take depreciation and leasing seriously

We undertake detailed modelling of fixed asset depreciation and lease calculation rules for both accounting and tax.

We monitor changes to ATO tax rulings and accounting standards like IAS 16 and IFRS 16 so you don’t have to.

And, of course, we are ISO27001 certified.

Why our clients love AssetAccountant

Fantastic product - has literally saved me hours of work.

Ever wanted the big company fixed asset system without all the clunkiness and overthinking on the part of the software developers (I'm looking at you Thomson Reuters...)? Well then you need AssetAccountant. It provides just the right mix of complex depreciation calculations and beautiful user interface. It's a system designed by accountants and executed perfectly by developers. The integration is seamless with Xero (you can sign into AA with Xero credentials which is awesome if you are already running Xero on your browser) and journaling synchs are very flexible between the two applications. Then there is the price. I challenge you to find a more robust fixed asset system at these price points. Well done AssetAccountant.

You get me.

I now have my big boy jocks back on for fixed asset management....and they fit!

Ready to kick some assets?

- AssetAccountant is fixed asset software that automates fixed asset depreciation & lease accounting and posts their journals to the General Ledger.

- AssetAccountant combines detailed interpretation of Tax and Accounting rules with a modern user interface design, to simplify the process of creating and maintaining your fixed asset register.

- AssetAccountant is sophisticated enough for Wall Street, user-friendly enough for main street.

- AssetAccountant is for worldwide application 🌎