Here are some examples of which asset cannot be depreciated:

Considering that a definition of fixed assets is: An asset used for generating business income that is not likely to be converted to cash or cash equivalents within the space of one fiscal year. They are also referred to as “non-current assets” or “long-term assets.”

While many fixed assets can be depreciated, there are some that cannot be depreciated for various reasons. Here are some examples of which asset cannot be depreciated:

Land

Land is typically regarded as an asset that does not depreciate since it is not anticipated to deteriorate, become outdated, or have a restricted lifespan. Nevertheless, any enhancements made to the land, such as constructions or landscaping, can be subject to depreciation.

Intangible Assets

Some intangible assets, like goodwill, trademarks, and copyrights, may not be depreciated. Instead, they are subject to amortization, which is the systematic allocation of their costs over their estimated useful lives.

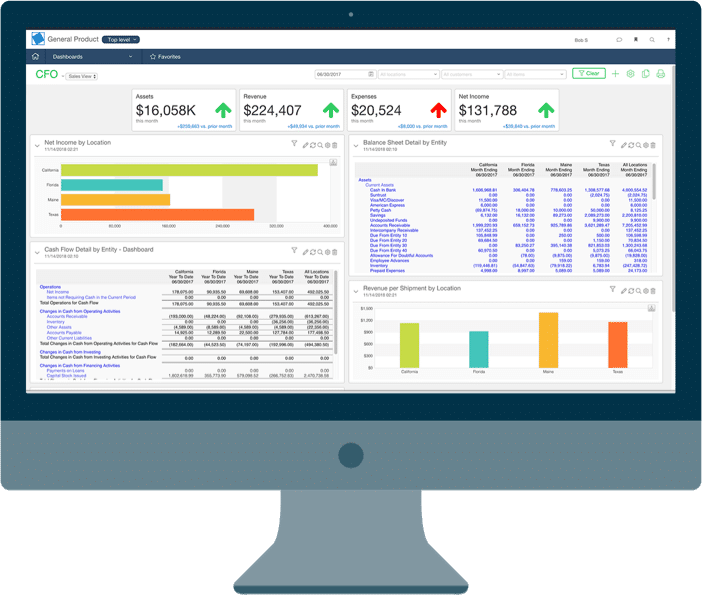

AssetAccountant – saving you from spreadsheets since 2019

Investments in Affiliated Companies

Investments in the stock of other companies are not typically depreciated. Instead, they may be subject to impairment charges if their value declines.

Natural Resources

Assets like mineral deposits and timber are not depreciated. Instead, their costs are typically accounted for through depletion.

Historical or Collectible Items

Items like rare art, historical artifacts, and collectibles may not be depreciated. Instead, they are often recorded at their historical cost and may be subject to periodic appraisals.

Leased Assets

If a company leases an asset under an operating lease (where they don’t take ownership at the end of the lease term), the leased asset is not typically depreciated. The lease payments are recorded as operating expenses.

It’s important to note that accounting rules and regulations can vary by jurisdiction and may change over time, so it’s essential to consult with a qualified accountant or follow the generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS) applicable in your region to determine the specific treatment of fixed assets in your financial statements and be sure which asset cannot be depreciated.

We take depreciation and leasing seriously

We undertake detailed modelling of fixed asset depreciation and lease calculation rules for both accounting and tax.

We monitor changes to ATO tax rulings and accounting standards like IAS 16 and IFRS 16 so you don’t have to.

And, of course, we are ISO27001 certified.

Why our clients love AssetAccountant

Fantastic product - has literally saved me hours of work.

Ever wanted the big company fixed asset system without all the clunkiness and overthinking on the part of the software developers (I'm looking at you Thomson Reuters...)? Well then you need AssetAccountant. It provides just the right mix of complex depreciation calculations and beautiful user interface. It's a system designed by accountants and executed perfectly by developers. The integration is seamless with Xero (you can sign into AA with Xero credentials which is awesome if you are already running Xero on your browser) and journaling synchs are very flexible between the two applications. Then there is the price. I challenge you to find a more robust fixed asset system at these price points. Well done AssetAccountant.

You get me.

I now have my big boy jocks back on for fixed asset management....and they fit!

Ready to kick some assets?

- AssetAccountant is fixed asset software that automates fixed asset depreciation & lease accounting and posts their journals to the General Ledger.

- AssetAccountant combines detailed interpretation of Tax and Accounting rules with a modern user interface design, to simplify the process of creating and maintaining your fixed asset register.

- AssetAccountant is sophisticated enough for Wall Street, user-friendly enough for main street.

- AssetAccountant is for worldwide application 🌎