Why is fixed asset depreciation important for small business?

Fixed asset depreciation plays a crucial role in fiscal management for businesses of all sizes.

It is not only a legal requirement for financial and tax purposes, but also a strategic tool for tax planning and maximizing profits.

With the help of AssetAccountant software, both small and large businesses can automate and streamline their fixed asset depreciation processes, enabling them to make informed decisions regarding asset acquisition, maintenance, and disposal.

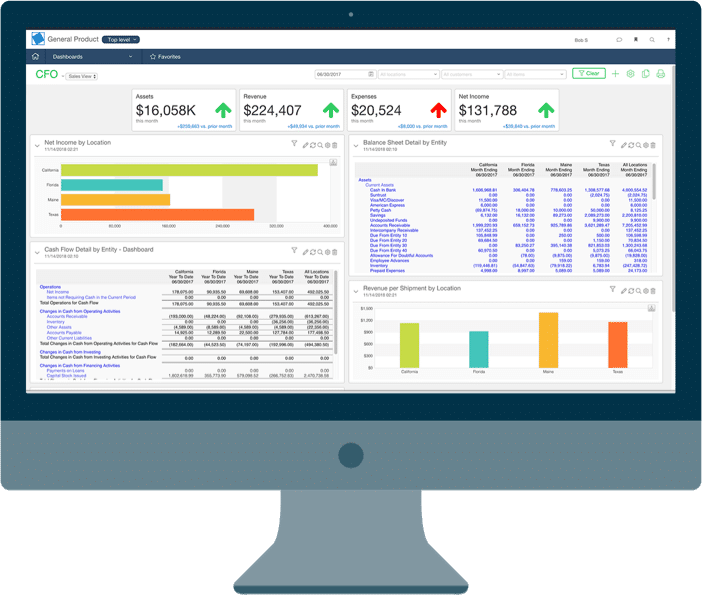

By utilizing AssetAccountant’s fixed asset management software, businesses can improve the efficiency of their fixed asset management. Our software seamlessly integrates with popular ERPs and general ledger software such as QuickBooks Online, Xero, Sage Intacct, and Microsoft Dynamics.

Implementing a reliable fixed asset management system like AssetAccountant simplifies the accounting process for fixed assets, ensuring compliance with regulations and accurate and timely reporting.

Calculating fixed asset depreciation

There are numerous types of property, plant, and equipment types that are eligible to be depreciated, resulting in a variety of depreciation calculation methods available to choose from.

It is important to consider these methods as they have an impact on your Profit and Loss statements and Balance Sheets, despite not affecting your Cash Flow. By exploring different depreciation methods, you can determine which one is most suitable for various scenarios.

Regardless of the depreciation method chosen, your company will still arrive at the same depreciation amount over time. The distinction lies in the timing of the deductions. By adjusting when you deduct costs for each asset, you can optimize your tax savings and effectively plan for new asset investments.

The most commonly used methods worldwide for depreciating fixed assets include the Straight Line method (also referred to as Prime Cost), Diminishing Value (also known as Declining Balance), and Units of Use method of depreciation.

Fixed asset depreciation software

The importance of using fixed asset depreciation software cannot be overstated. Without proper management, fixed assets can become a liability rather than an asset!

Software solutions provide businesses with the tools they need to track, maintain, and dispose of their fixed assets. This includes tracking the acquisition and disposal of assets, as well as maintaining accurate records of their location, condition, and value. By using software, businesses can ensure that their fixed assets are being used effectively and efficiently.

Using spreadsheets or other manual processes to manage fixed assets can be risky and inefficient. Spreadsheets are prone to errors, and it can be difficult to keep them up-to-date.

Manual processes are also time-consuming, and it can be challenging to ensure that all of the necessary information is included. With software solutions, businesses can automate many of the tasks associated with fixed asset management, saving time and reducing the risk of errors.

AssetAccountant – saving you from spreadsheets since 2019

Tax and Accounts: 2 requirements for fixed asset depreciation

Differentiating between accounting fixed asset treatment and tax fixed asset treatment is essential for businesses.

Accounting fixed asset treatment refers to how assets are recorded on a company’s financial statements, while tax fixed asset treatment refers to how assets are treated for tax purposes and reporting of this to your jurisdiction’s regulatory agency (e.g. IRS – USA, IRD – New Zealand, ATO – Australia, CRA – Canada, etc)

It is important to understand the difference between the two, as they can have a significant impact on a company’s financial and tax position.

For Accounting, your fixed asset register should reflect the value of an asset at any time during its useful life.

And the ‘cost’ of the asset should be spread across the asset’s useful life. This allows you to reflect the cost to use that asset to produce income in any given period.

Typically, assets are depreciated more aggressively for Tax purposes. This depends on allowances each jurisdiction’s agency allows.

By using Tax = Accounting depreciation, as well as distorting the true value of assets to a business, depreciating too aggressively reduces the value of those assets on the balance sheet as well as reducing profits on the P&L – therefore potentially undervaluing the business.

This can have significant impacts on a business’ ability to borrow, meet banking loan covenants, and sell the business at a fair value.

AssetAccountant is vital fixed asset management software that keeps separate asset registers for tax and accounting ensuring that you maximise taxable deductions and maximise the value of the business on the balance sheet.

We take depreciation and leasing seriously

We undertake detailed modelling of fixed asset depreciation and lease calculation rules for both accounting and tax.

We monitor changes to ATO tax rulings and accounting standards like IAS 16 and IFRS 16 so you don’t have to.

And, of course, we are ISO27001 certified.

Why our clients love AssetAccountant

Fantastic product - has literally saved me hours of work.

Ever wanted the big company fixed asset system without all the clunkiness and overthinking on the part of the software developers (I'm looking at you Thomson Reuters...)? Well then you need AssetAccountant. It provides just the right mix of complex depreciation calculations and beautiful user interface. It's a system designed by accountants and executed perfectly by developers. The integration is seamless with Xero (you can sign into AA with Xero credentials which is awesome if you are already running Xero on your browser) and journaling synchs are very flexible between the two applications. Then there is the price. I challenge you to find a more robust fixed asset system at these price points. Well done AssetAccountant.

You get me.

I now have my big boy jocks back on for fixed asset management....and they fit!

Ready to kick some assets?

- AssetAccountant is fixed asset software that automates fixed asset depreciation & lease accounting and posts their journals to the General Ledger.

- AssetAccountant combines detailed interpretation of Tax and Accounting rules with a modern user interface design, to simplify the process of creating and maintaining your fixed asset register.

- AssetAccountant is sophisticated enough for Wall Street, user-friendly enough for main street.

- AssetAccountant is for worldwide application 🌎